“With close to 5 billion mobile phone subscribers but only 1.5 billion credit cards worldwide, mobile money is believed to be one great revenue source. This presents an opportunity for mobile operators to add value to both people who do not have access to traditional financial institutions and the financial institutions themselves.

The mobile money market has competently established itself as one of the fastest growing markets globally and still exhibits growth of 44.6% between 2014 and 2019.

For example, Africa accounted for nearly 70% of the world’s active mobile money customers in 2013.”

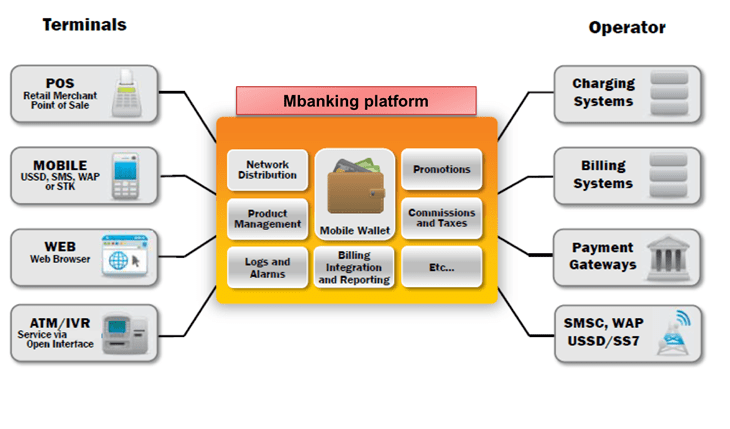

Mobile Banking uses non bank distributors and information technology infrastructure to provide financial services to low-income customers outside the traditional banking methods.

With the same infrastructure, we power our clients with a full suite of electronic payment solution that allows the Subscriber and depositor to send money from his account to a creditor or vendor both domestically and internationally.

Our powerful Mobile banking solution highlights some importants features like:

- Send/receive money to the bank accounts.

- Cash-In & Cash-Out and inter transfers

- Pay bills and pay for goods and services – Shopping

- Top up own airtime account or Top up someone else’s.

- Charges, Commissions and loyalty programs

- KYC & Life Cycle Management of Mobile Subscriber

- Anti-Money Laundering (AML) and CFT Settings

- Multi Pocket wallets integration

- Ease of integration to any financial institution and merchants using ISO8583, XML/HTTPS, SFTP and various web services

- Merchant nicknames and intelligence

- Cross-border (other country) virtual Cash transfers and management

- Master Card, MoneyGram, Western Union integration

For more information please contact our Strategy solutions department at strategy@bostonsolux.com